Valid South Carolina Durable Power of Attorney Document

In South Carolina, the Durable Power of Attorney (DPOA) form serves as a vital tool for individuals seeking to designate someone to make financial and legal decisions on their behalf when they are unable to do so themselves. This form empowers a chosen agent, often a trusted family member or friend, to manage various aspects of the principal's affairs, including handling bank transactions, managing real estate, and making investment decisions. One of the key features of the DPOA is its durability; it remains effective even if the principal becomes incapacitated, ensuring that there is no interruption in the management of their affairs. Additionally, the form can be tailored to fit specific needs, allowing the principal to grant broad or limited powers based on their preferences. Understanding the implications of this document is crucial, as it not only provides peace of mind but also safeguards against potential disputes among family members regarding decision-making authority. As individuals navigate the complexities of estate planning, the South Carolina Durable Power of Attorney emerges as an essential component in ensuring that their wishes are respected and carried out, even in times of uncertainty.

Key takeaways

Filling out and using a Durable Power of Attorney (DPOA) form in South Carolina can be a crucial step in ensuring that your financial and healthcare decisions are handled according to your wishes. Here are some key takeaways to consider:

- Understand the Purpose: A Durable Power of Attorney allows you to designate someone to make decisions on your behalf if you become incapacitated.

- Choose Your Agent Wisely: Select someone you trust completely, as they will have significant authority over your financial and medical matters.

- Specify Powers Clearly: Be explicit about the powers you are granting. This can include managing finances, selling property, or making healthcare decisions.

- Consider a Successor Agent: Appointing a backup agent ensures that someone can step in if your primary agent is unable or unwilling to serve.

- Sign in Front of Witnesses: In South Carolina, your DPOA must be signed in the presence of two witnesses or a notary public to be valid.

- Review Regularly: Life circumstances change, so it’s wise to review and update your DPOA periodically to reflect your current wishes.

- Communicate Your Wishes: Discuss your decisions with your chosen agent and family members to ensure everyone understands your intentions.

By keeping these points in mind, you can create a Durable Power of Attorney that effectively safeguards your interests and provides peace of mind for you and your loved ones.

Dos and Don'ts

When filling out the South Carolina Durable Power of Attorney form, it is essential to approach the process with care and attention to detail. Below are guidelines that can help ensure the form is completed correctly.

- Do ensure you understand the powers you are granting to your agent.

- Do use clear and concise language throughout the form.

- Do sign the document in the presence of a notary public.

- Do keep a copy of the signed document for your records.

- Don't leave any sections of the form blank unless specified.

- Don't rush through the process; take your time to review each section.

- Don't use outdated forms; ensure you have the most current version.

- Don't forget to discuss your decisions with your chosen agent before completing the form.

Guidelines on Utilizing South Carolina Durable Power of Attorney

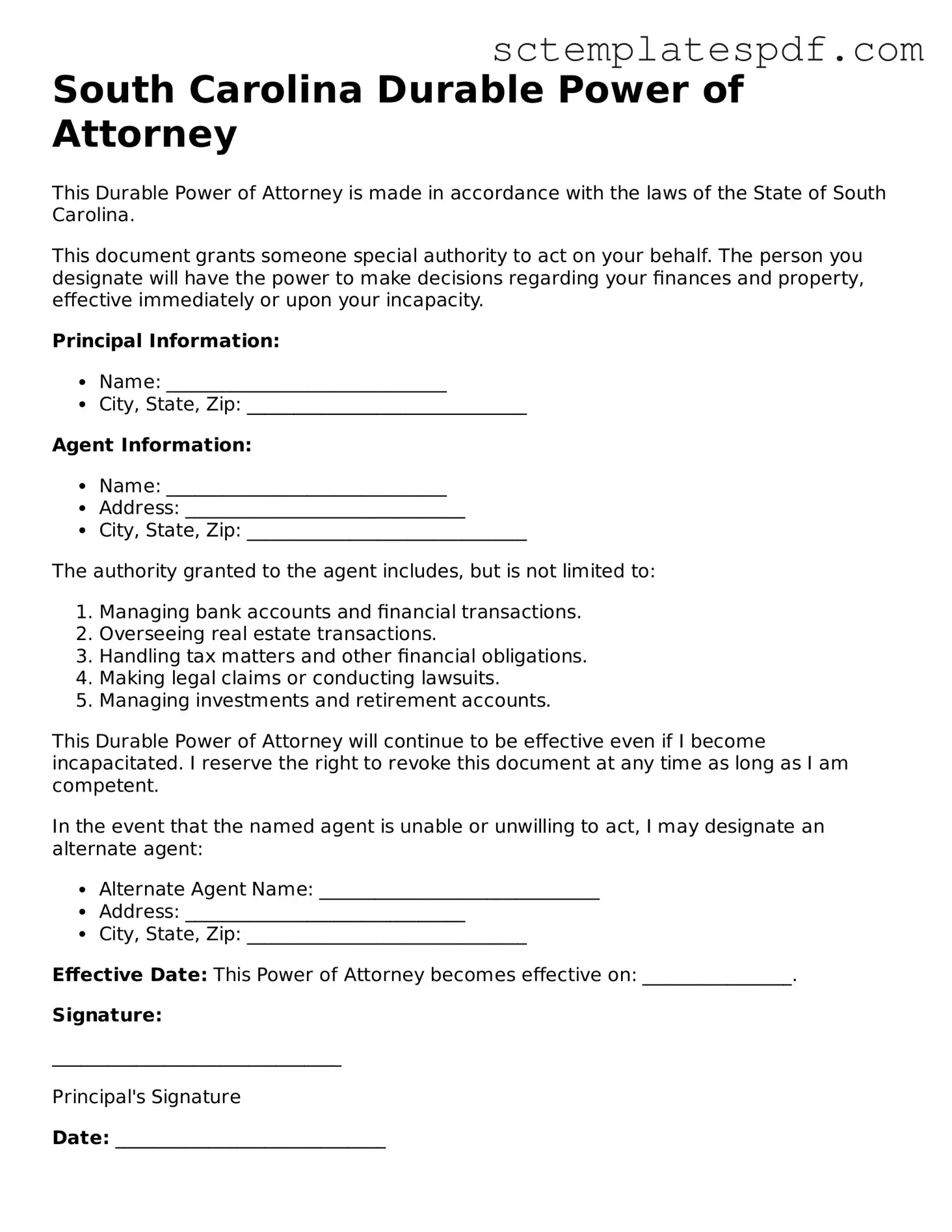

Filling out the South Carolina Durable Power of Attorney form is an important step in planning for your future. This document allows you to designate someone you trust to make decisions on your behalf if you are unable to do so. It is essential to approach this process with care to ensure that your wishes are clearly communicated.

- Obtain the Durable Power of Attorney form. You can find it online or request a copy from a legal professional.

- Read through the form carefully to understand each section. Familiarize yourself with the roles and responsibilities involved.

- Begin by entering your personal information at the top of the form. This includes your full name, address, and date of birth.

- Next, identify the person you are appointing as your agent. Provide their full name, address, and relationship to you.

- Specify the powers you wish to grant your agent. You can choose general powers or limit them to specific areas, such as financial or medical decisions.

- Include any additional instructions or limitations that you want to apply to your agent’s authority.

- Sign and date the form in the designated area. Make sure to do this in the presence of a notary public.

- Have the document notarized. This step is crucial for ensuring the validity of the form.

- Distribute copies of the completed and notarized form to your agent and any relevant parties, such as family members or healthcare providers.

Once you have completed these steps, the Durable Power of Attorney form will be ready for use. Ensure that you keep a copy in a safe place and inform your agent where to find it. This way, your wishes will be respected when the time comes.

Other Popular South Carolina Forms

South Carolina Prenuptial Contract - A prenuptial agreement can address how future assets will be treated as well.

The use of a Small Estate Affidavit form is crucial for simplifying the transfer of a deceased person's assets, especially when they leave behind a small amount. This legal document streamlines the process, allowing heirs to claim property without enduring a lengthy probate journey. To ensure the process is conducted properly, one may refer to the Small Estate Affidavit form, which provides the necessary guidelines for managing these small estates effectively.

Notary Signature Example South Carolina - The notary logs the acknowledgment in their official records for future reference.

Mobile Home Title Search - Complete your mobile home sale with this vital document.