Valid South Carolina Operating Agreement Document

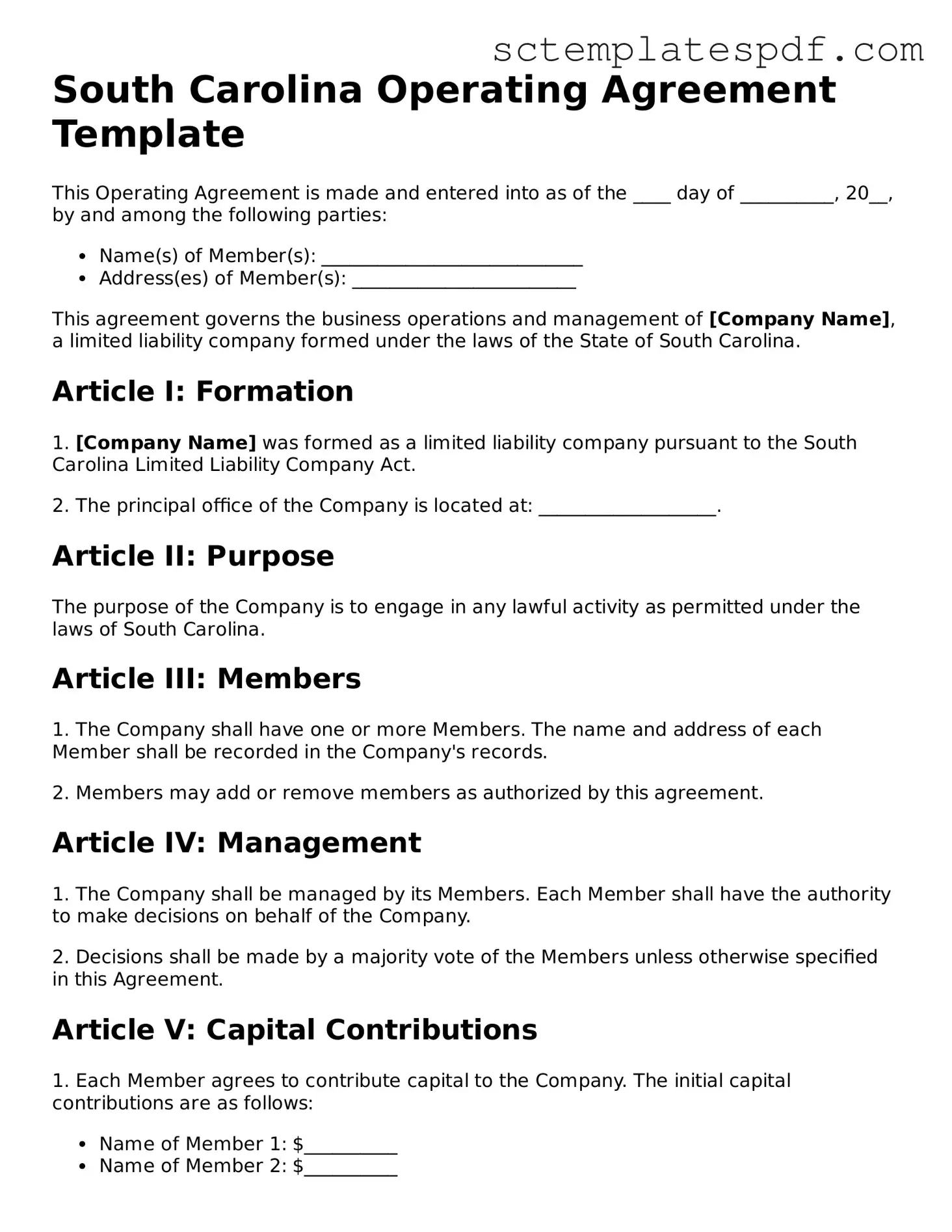

In South Carolina, the Operating Agreement is a crucial document for limited liability companies (LLCs) as it outlines the management structure, operational procedures, and financial arrangements among members. This form serves as a foundational blueprint, detailing each member's rights and responsibilities while also addressing how profits and losses will be allocated. Key elements typically included are the voting rights of members, the process for admitting new members, and the procedures for resolving disputes. Additionally, the agreement can specify the duration of the LLC, guidelines for meetings, and the roles of managers if the company opts for a management structure. By clearly defining these aspects, the Operating Agreement not only helps prevent misunderstandings but also provides a framework for the company's governance, ensuring that all members are on the same page regarding their business operations.

Key takeaways

When filling out and using the South Carolina Operating Agreement form, keep these key takeaways in mind:

- Understand the purpose of the Operating Agreement. It outlines the management structure and operating procedures of your business.

- Gather all necessary information before starting. This includes details about the members, their contributions, and profit-sharing arrangements.

- Clearly define the roles and responsibilities of each member. This helps avoid confusion and ensures everyone knows their duties.

- Include provisions for decision-making processes. Specify how decisions will be made and what constitutes a quorum for meetings.

- Address the process for adding or removing members. This is crucial for maintaining flexibility as your business evolves.

- Outline the procedures for resolving disputes. Having a clear plan can save time and reduce conflicts down the line.

- Ensure compliance with state laws. Review South Carolina regulations to ensure your agreement meets all legal requirements.

- Consider seeking legal advice. A professional can help ensure that your Operating Agreement is comprehensive and tailored to your business needs.

Dos and Don'ts

When filling out the South Carolina Operating Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are some dos and don’ts to consider:

- Do read the form carefully before starting to fill it out.

- Do provide accurate and complete information for all required fields.

- Do consult with a legal professional if you have questions about the content.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank; this could delay processing.

- Don't use vague language; be specific in your descriptions.

- Don't forget to sign and date the form before submission.

Guidelines on Utilizing South Carolina Operating Agreement

Completing the South Carolina Operating Agreement form is an important step for members of a Limited Liability Company (LLC). This document outlines the management structure and operating procedures of the LLC. After filling out the form, members should review it carefully to ensure that all information is accurate and complete before finalizing the agreement.

- Begin by entering the name of your LLC at the top of the form. Ensure that the name matches the one registered with the state.

- Next, provide the principal office address of the LLC. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members involved in the LLC. Include their ownership percentages if applicable.

- Indicate the management structure of the LLC. Specify whether it will be member-managed or manager-managed.

- Outline the purpose of the LLC. Describe the business activities the LLC intends to engage in.

- Detail the capital contributions of each member. Specify what each member is contributing to the LLC, whether it be cash, property, or services.

- Include provisions for profit and loss distribution. Clearly state how profits and losses will be allocated among the members.

- Address the process for adding new members or removing existing ones. Include any necessary voting procedures.

- Specify the duration of the LLC. Indicate whether it will be perpetual or if there is a defined end date.

- Finally, ensure that all members sign and date the agreement. This step is crucial for validating the document.

Other Popular South Carolina Forms

Non-disclosure Agreement - An NDA ensures that discussions about new products or services remain confidential.

The North Carolina Homeschool Letter of Intent form is a crucial document that parents must submit to officially notify the state of their decision to homeschool their children. This form serves as a declaration of intent and helps ensure that families comply with state regulations regarding homeschooling. By completing this form, parents take an important step in providing their children with a personalized education tailored to their unique needs and learning styles. For more information, you can visit homeschoolintent.com/editable-north-carolina-homeschool-letter-of-intent/.

How to Avoid Probate in South Carolina - Beneficiaries can usually claim their inheritance without additional legal advice unless disputes arise.