Valid South Carolina Promissory Note Document

In South Carolina, a Promissory Note serves as a vital financial instrument that outlines the terms of a loan between a borrower and a lender. This written agreement is not merely a piece of paper; it represents a commitment to repay borrowed funds under specified conditions. Key components typically included in the Promissory Note are the principal amount, the interest rate, and the repayment schedule. Additionally, it often details the consequences of default, which can protect the lender's interests while ensuring the borrower is aware of their obligations. Understanding these elements is crucial for both parties, as they establish the framework for the financial relationship. The clarity provided by a well-drafted Promissory Note can help prevent misunderstandings and disputes down the line, making it an essential document in the realm of personal and business financing in South Carolina.

Key takeaways

When dealing with the South Carolina Promissory Note form, it’s essential to understand its key components and implications. Here are some important takeaways to keep in mind:

- Clear Terms: Ensure that the terms of the loan, including the amount, interest rate, and repayment schedule, are clearly outlined. Ambiguity can lead to disputes down the line.

- Signatures Matter: Both the borrower and lender must sign the document for it to be legally binding. Without signatures, the note may not hold up in court.

- Consider Legal Advice: While filling out the form may seem straightforward, consulting with a legal expert can provide clarity on your rights and obligations.

- Record Keeping: Keep a copy of the signed Promissory Note for your records. This document serves as proof of the loan and the agreed-upon terms.

Understanding these points can help ensure that your use of the South Carolina Promissory Note is effective and legally sound.

Dos and Don'ts

When filling out the South Carolina Promissory Note form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things to do and avoid:

- Do provide accurate information for all parties involved, including names and addresses.

- Do specify the loan amount clearly and concisely.

- Do include the interest rate, if applicable, and ensure it complies with state regulations.

- Do outline the repayment schedule, including due dates and payment amounts.

- Do sign and date the document in the presence of a witness or notary, if required.

- Don't leave any sections blank; all fields must be completed to avoid confusion.

- Don't use ambiguous language; be clear and straightforward in your wording.

Following these guidelines will help ensure that the Promissory Note is valid and enforceable in South Carolina.

Guidelines on Utilizing South Carolina Promissory Note

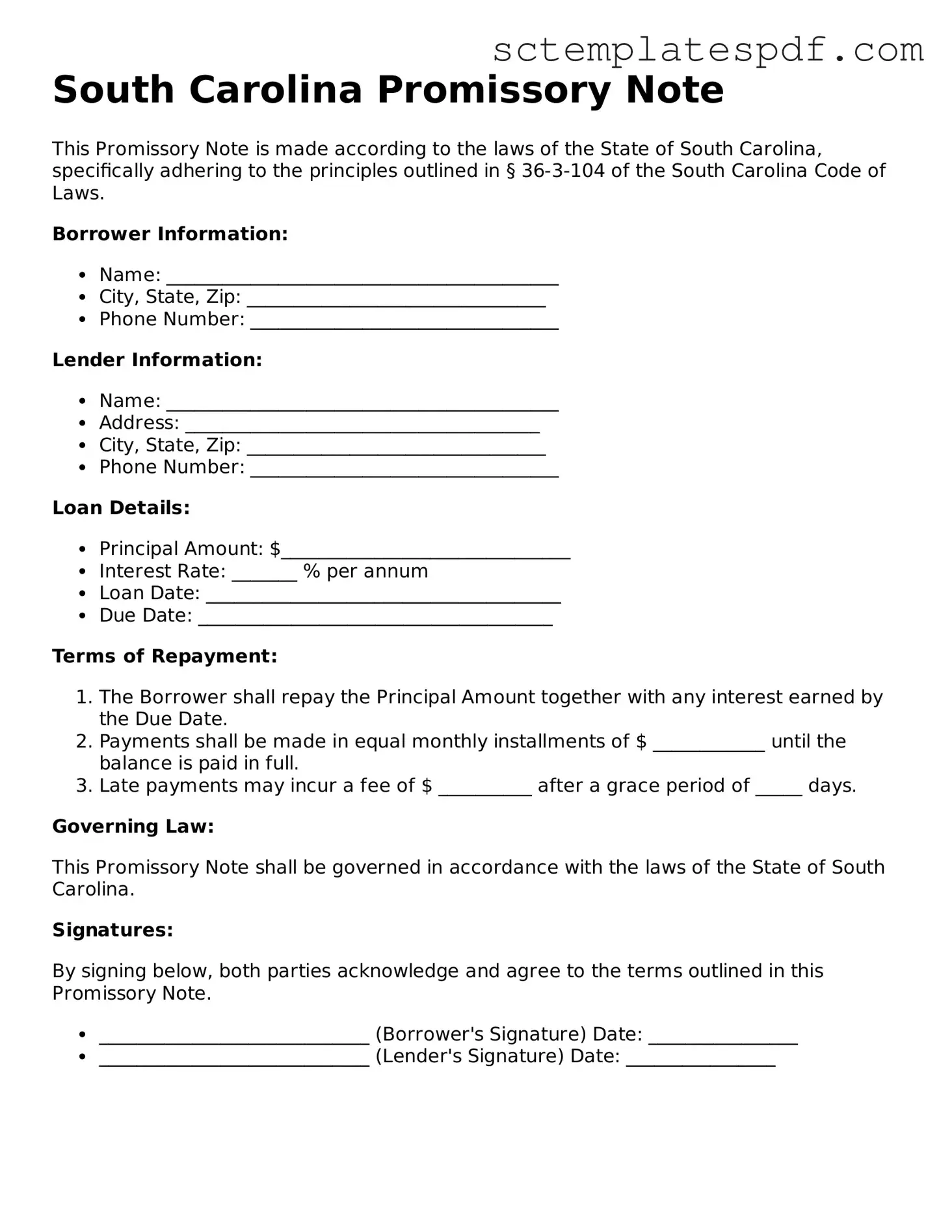

Once you have obtained the South Carolina Promissory Note form, you will be ready to fill it out with the necessary information. Completing this document accurately is essential for establishing the terms of the loan agreement between the parties involved. Follow the steps below to ensure that you fill out the form correctly.

- Begin by entering the date at the top of the form. This should be the date on which the promissory note is being executed.

- Next, identify the borrower. Write the full name and address of the individual or entity borrowing the money.

- Following that, provide the lender's information. Include the full name and address of the person or organization lending the money.

- Clearly state the principal amount of the loan. This is the total sum of money being borrowed.

- Specify the interest rate. Indicate whether the interest is fixed or variable and provide the applicable percentage.

- Outline the repayment terms. Include details about the payment schedule, such as monthly or quarterly payments, and the duration of the loan.

- Include any late fees or penalties for missed payments, if applicable. Be clear about how these fees will be calculated.

- Sign and date the form at the bottom. The borrower should sign, and if applicable, the lender should also sign to acknowledge the agreement.

- Finally, make copies of the completed promissory note for both the borrower and the lender for their records.

Other Popular South Carolina Forms

Last Will and Testament Sc - Specify your desires to minimize emotional strain on your loved ones.

For those looking to understand the process of transferring ownership, the North Carolina Motorcycle Bill of Sale can be found in this helpful guide on Motorcycle Bill of Sale documentation, ensuring you have all the information you need for a seamless transaction.

Free South Carolina Real Estate Contract - This form is crucial for a smooth real estate transaction.

Notary Signature Example South Carolina - This form is often required by courts for certain legal filings.