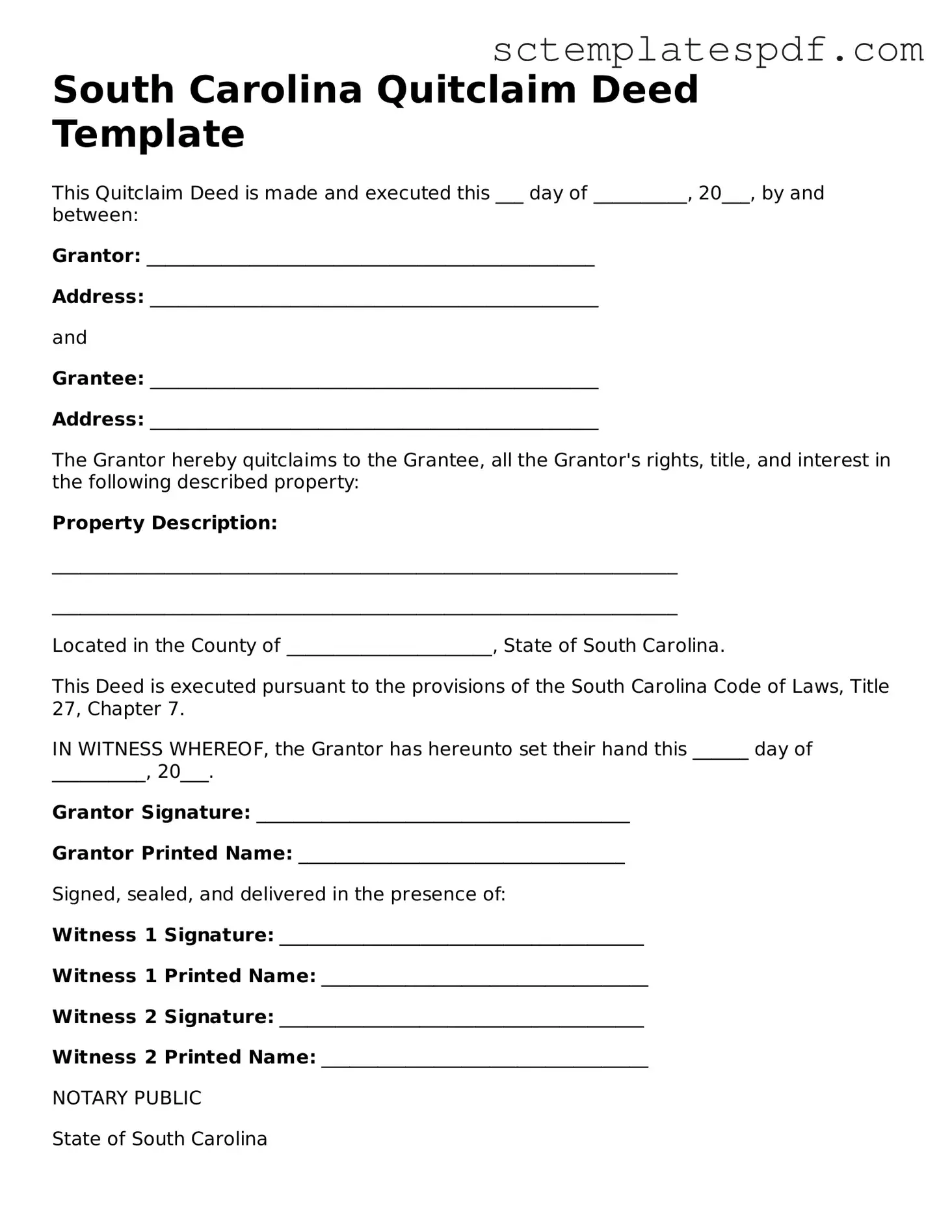

Valid South Carolina Quitclaim Deed Document

The South Carolina Quitclaim Deed form serves as a crucial legal document for property transfers, particularly when the seller's interest in the property is not fully guaranteed. This form allows an individual, known as the grantor, to convey their interest in real estate to another party, called the grantee, without making any promises about the title's validity. Unlike warranty deeds, which provide assurances regarding the title, a quitclaim deed transfers whatever interest the grantor has, if any, without warranties. This makes it a popular choice for situations such as family transfers, divorce settlements, or clearing up title issues. Additionally, the form must be properly executed and notarized to ensure its legal effectiveness. Understanding the implications of using a quitclaim deed is essential, as it can significantly affect the rights of the parties involved and the future ownership of the property.

Key takeaways

When filling out and using the South Carolina Quitclaim Deed form, it is important to keep several key points in mind. Here are eight essential takeaways:

- Purpose of the Quitclaim Deed: This form is primarily used to transfer ownership of property without making any guarantees about the title. It is often utilized in situations such as transferring property between family members.

- Property Description: Clearly describe the property being transferred. Include the full legal description, which can typically be found in the original deed or property tax records.

- Grantor and Grantee Information: Provide the full names and addresses of both the grantor (the person transferring the property) and the grantee (the person receiving the property). Accurate information is crucial.

- Notarization Requirement: The Quitclaim Deed must be signed in the presence of a notary public. This step is necessary to validate the document and ensure it is legally binding.

- Recording the Deed: After completion, the Quitclaim Deed should be recorded with the county clerk's office where the property is located. This step is essential to protect the grantee’s rights.

- Tax Implications: Be aware of any potential tax implications when transferring property. Consulting a tax professional can provide clarity on any taxes owed as a result of the transfer.

- Use of Legal Assistance: Although a Quitclaim Deed can be filled out without legal help, it is advisable to consult with an attorney if there are any uncertainties about the process or implications.

- Limitations of the Quitclaim Deed: Understand that this type of deed does not guarantee that the grantor has clear title to the property. It simply transfers whatever interest the grantor has.

By keeping these points in mind, individuals can navigate the Quitclaim Deed process more effectively and ensure a smoother transfer of property ownership.

Dos and Don'ts

When filling out the South Carolina Quitclaim Deed form, it’s important to follow certain guidelines to ensure accuracy and legality. Here are nine things you should and shouldn’t do:

- Do double-check the names of all parties involved. Ensure they are spelled correctly.

- Don’t leave any fields blank. Every section must be filled out appropriately.

- Do include a legal description of the property. This is crucial for identification.

- Don’t use abbreviations or informal language in the deed.

- Do sign the deed in the presence of a notary public. This adds validity to the document.

- Don’t forget to date the document. An undated deed can lead to confusion.

- Do check local recording requirements. Some counties may have specific rules.

- Don’t submit the form without making a copy for your records.

- Do file the deed with the appropriate county office as soon as possible.

Following these guidelines will help ensure that your Quitclaim Deed is completed correctly and efficiently. Take the time to review each step carefully.

Guidelines on Utilizing South Carolina Quitclaim Deed

Once you have the South Carolina Quitclaim Deed form in hand, it’s essential to ensure that all necessary information is accurately provided. Completing the form correctly is crucial for the transfer of property rights. Here’s a clear set of steps to guide you through the process.

- Begin by entering the name of the current owner(s) of the property in the designated space. This is often referred to as the "Grantor." Ensure that the names are spelled correctly.

- Next, fill in the name of the person or entity receiving the property, known as the "Grantee." Double-check the spelling of their name as well.

- Provide the complete address of the property being transferred. Include the street address, city, state, and ZIP code.

- Include a legal description of the property. This may be found in previous deeds or property tax records. It’s important for this description to be precise.

- Indicate the date of the transfer. This should be the date on which the document is signed.

- Sign the form. The Grantor must sign the Quitclaim Deed in the presence of a notary public. The notary will also need to sign and seal the document.

- After notarization, make sure to file the Quitclaim Deed with the appropriate county office. This is typically the Register of Deeds or the County Clerk’s office.

Completing these steps will help ensure that the Quitclaim Deed is filled out properly. Once filed, the deed becomes part of the public record, solidifying the property transfer.

Other Popular South Carolina Forms

How Long Do You Have to Turn in Your License Plates in Sc - This form is particularly beneficial for individuals who may be unable to travel to complete vehicle transactions.

When preparing to complete the necessary documentation for your tractor sale, it's important to utilize the appropriate forms, such as the Missouri PDF Forms, which provide essential templates and guidelines to ensure that all legal aspects of the transaction are properly addressed.

South Carolina Trailer Registration - The RV Bill of Sale is useful for any private or dealership transaction involving recreational vehicles.