Valid South Carolina Small Estate Affidavit Document

In South Carolina, managing the estate of a deceased loved one can often feel overwhelming, especially when it comes to navigating the legal requirements involved. For individuals facing the loss of someone close, the Small Estate Affidavit form offers a streamlined process for settling estates that fall below a certain value threshold. This form allows heirs and beneficiaries to bypass the lengthy and often complicated probate process, provided the estate meets specific criteria. Typically, the Small Estate Affidavit can be utilized when the total value of the estate does not exceed $25,000, excluding certain assets like real estate. By completing this affidavit, individuals can claim personal property and settle debts without the need for formal court proceedings. The process involves gathering necessary documentation, including proof of death and a list of assets, and submitting the affidavit to the appropriate parties, such as financial institutions or other entities holding the deceased's assets. Understanding the requirements and implications of using the Small Estate Affidavit can significantly ease the burden during a difficult time, allowing families to focus on healing while ensuring that their loved one's affairs are handled efficiently.

Key takeaways

Filling out and using the South Carolina Small Estate Affidavit can simplify the process of settling an estate. Here are some key takeaways to consider:

- The Small Estate Affidavit is designed for estates valued at $25,000 or less, excluding real estate.

- Only certain individuals, such as heirs or beneficiaries, can use this form.

- The affidavit must be completed accurately to avoid delays in the estate settlement process.

- Gather all necessary information, including the deceased's assets and debts, before starting the form.

- Once completed, the affidavit must be filed with the probate court in the county where the deceased lived.

- It is important to have the form notarized to ensure its validity.

- After filing, you may need to provide copies to financial institutions or other entities holding the deceased's assets.

- Using this affidavit can help heirs access funds and property without the need for a formal probate process.

Dos and Don'ts

When filling out the South Carolina Small Estate Affidavit form, it’s important to follow specific guidelines. Here’s a list of things you should and shouldn’t do:

- Do read the instructions carefully before you start filling out the form.

- Do provide accurate information about the deceased and their assets.

- Do ensure that you are eligible to use the Small Estate Affidavit process.

- Do sign the affidavit in front of a notary public.

- Do keep copies of the completed form for your records.

- Don't leave any sections of the form blank; fill in all required fields.

- Don't provide false information, as this can lead to legal consequences.

- Don't rush through the process; take your time to ensure everything is correct.

- Don't forget to check the filing requirements for your local probate court.

Guidelines on Utilizing South Carolina Small Estate Affidavit

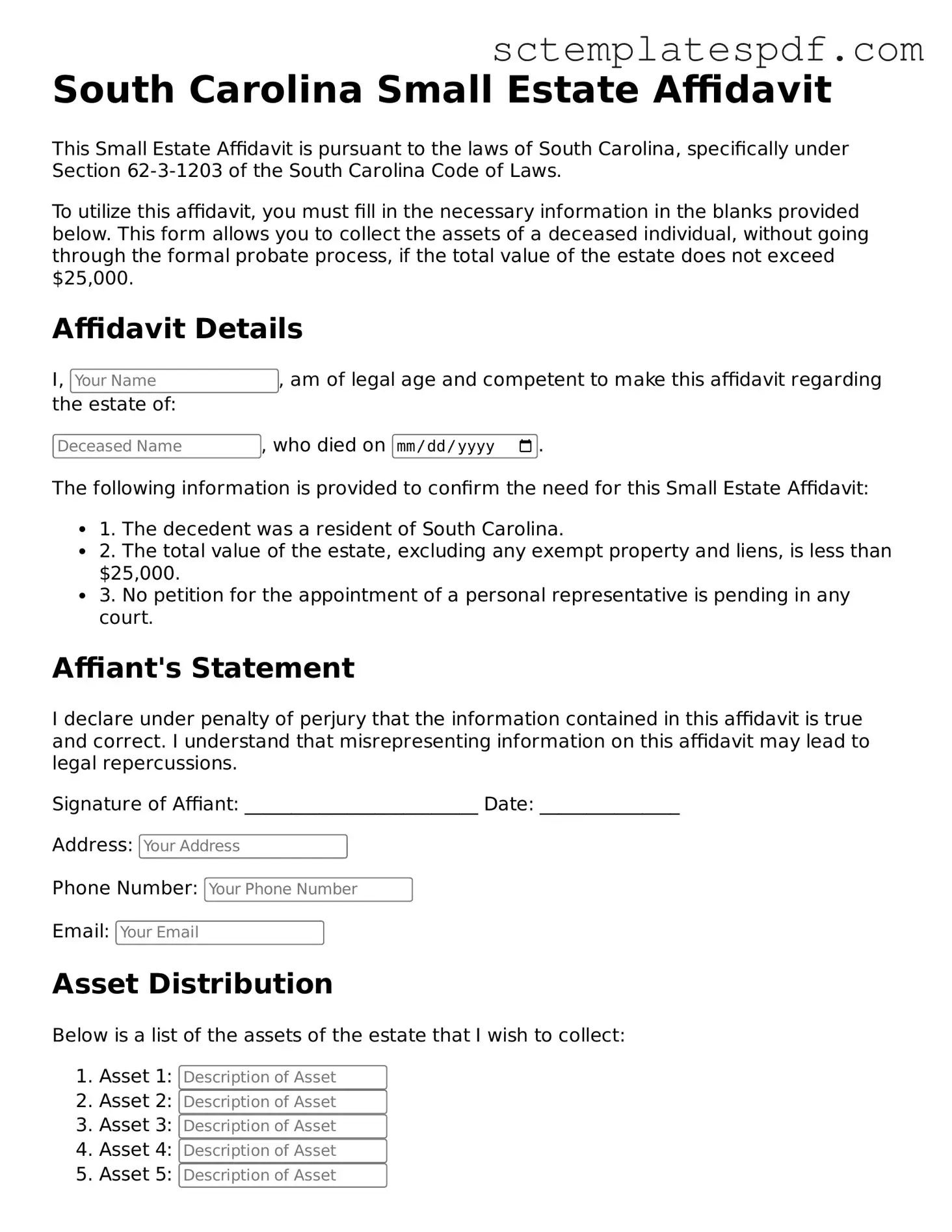

After gathering all necessary information and documents, you are ready to fill out the South Carolina Small Estate Affidavit form. This form allows you to claim property from a deceased person's estate without going through a lengthy probate process. Follow these steps carefully to ensure that the form is completed correctly.

- Obtain the Small Estate Affidavit form. You can find it online or at your local probate court.

- Fill in your name and address at the top of the form. Make sure to include your contact information.

- Provide the name of the deceased person. This should be the full name as it appears on legal documents.

- Enter the date of the deceased person's death. This date is crucial for determining the estate's eligibility for the small estate process.

- List all heirs of the deceased. Include their names, relationships to the deceased, and addresses.

- Detail the assets of the estate. Include a description of each asset and its estimated value. Be as specific as possible.

- Indicate whether there are any outstanding debts or claims against the estate. If there are, provide details about these obligations.

- Sign the affidavit in the presence of a notary public. This step is important for validating your statements.

- Make copies of the completed form for your records and for any relevant parties.

- File the original affidavit with the probate court in the county where the deceased lived.

Once the form is filed, the court will review it. If everything is in order, you will receive confirmation, allowing you to proceed with the transfer of assets. Keep all documents related to this process for future reference.

Other Popular South Carolina Forms

South Carolina Bill of Sale Form 4031 - It's crucial for both buyer and seller to sign the Motorcycle Bill of Sale to validate the document.

For those seeking a reliable record of their motorcycle transactions, our informative guide on the Motorcycle Bill of Sale documentation is indispensable. It details the necessary steps to ensure that both parties have a clear understanding of the sale, safeguarding against future disputes. To learn more, you can find our resource here: important aspects of the Motorcycle Bill of Sale form.

South Carolina Power of Attorney Form - This legal document can be crucial for managing health care decisions.