South Carolina 1102 Template

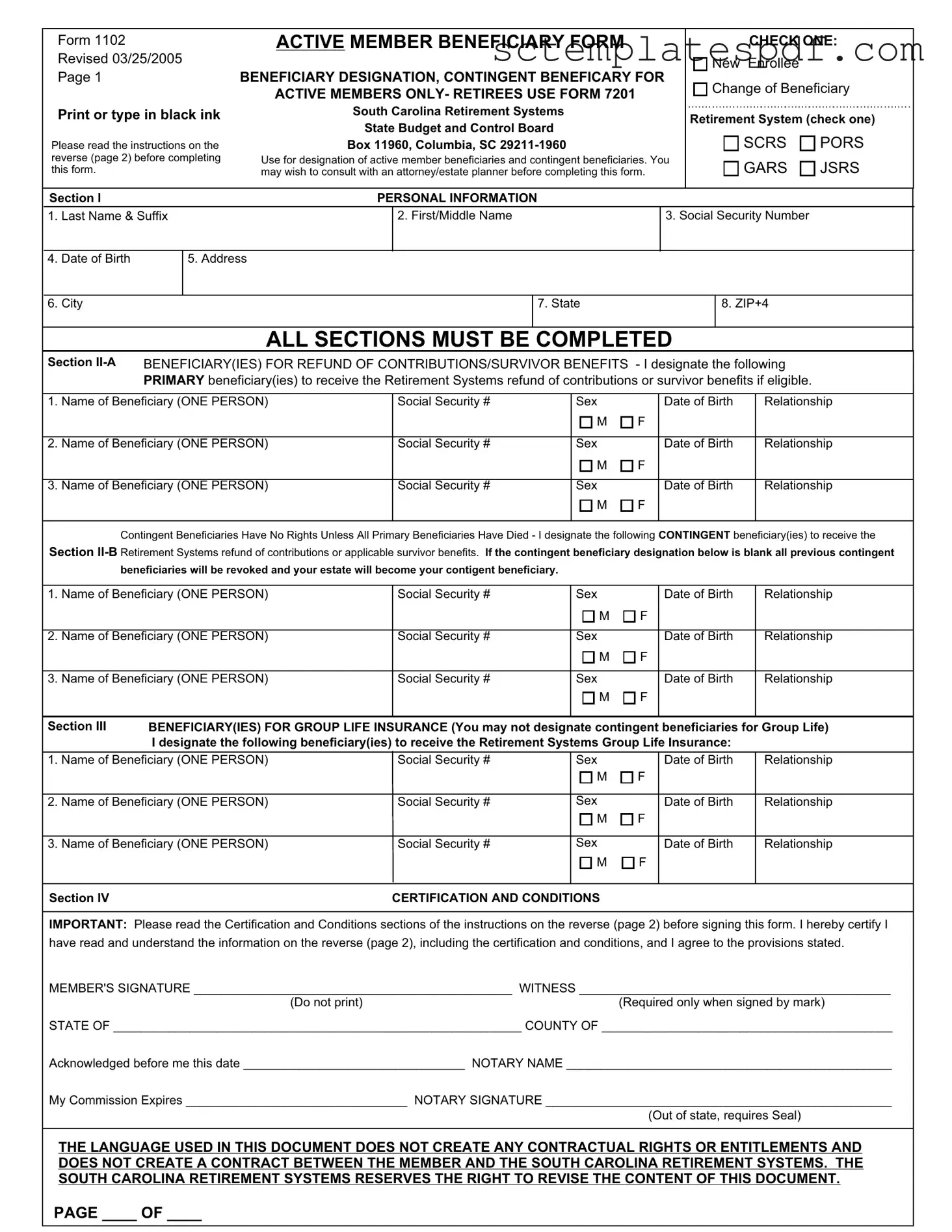

The South Carolina 1102 form plays a critical role for active members of the South Carolina Retirement Systems, serving as the official document for designating beneficiaries. This form allows members to specify who will receive their retirement contributions or survivor benefits in the event of their passing. It is essential for individuals to complete the form accurately, as it includes sections for both primary and contingent beneficiaries. The primary beneficiaries are those who will receive benefits directly, while contingent beneficiaries are designated to receive benefits only if all primary beneficiaries are deceased. Additionally, the form addresses group life insurance beneficiaries, which can differ from those named for retirement contributions. Members must ensure that all sections are filled out completely and that the form is notarized to validate their designations. The instructions accompanying the form emphasize the importance of consulting with an attorney or estate planner, ensuring that members make informed decisions regarding their beneficiary choices. Understanding these components is vital for anyone navigating the complexities of retirement planning in South Carolina.

Key takeaways

Filling out the South Carolina 1102 form is an important step for active members designating beneficiaries. Here are some key takeaways to keep in mind:

- Complete All Sections: Ensure that every section of the form is filled out completely. Incomplete forms may lead to delays or issues with beneficiary designations.

- Primary and Contingent Beneficiaries: You can designate primary beneficiaries to receive benefits. Contingent beneficiaries are only eligible if all primary beneficiaries have passed away.

- Consultation Recommended: It may be beneficial to consult with an attorney or estate planner before completing the form to ensure that your wishes are accurately reflected.

- Notarization Required: The form must be signed in the presence of a notary public. This step is crucial for the validity of the form.

- Revocation of Previous Designations: By submitting the 1102 form, all previous beneficiary designations will be revoked. Make sure to review your current designations before submitting.

- Group Life Insurance: Different beneficiaries can be designated for Group Life Insurance. Be sure to specify this information clearly on the form.

Taking the time to carefully complete the South Carolina 1102 form can help ensure that your benefits are distributed according to your wishes. Always keep a copy of the completed form for your records.

Dos and Don'ts

When filling out the South Carolina 1102 form, attention to detail is essential. Here’s a guide to help ensure a smooth process. Follow these dos and don’ts to avoid common pitfalls.

- Do read the instructions on the reverse side of the form before starting.

- Do print or type your information in black ink for clarity.

- Do complete all sections of the form each time you submit it.

- Do check the appropriate boxes to indicate whether you are a new enrollee or changing beneficiaries.

- Do ensure you have the correct Social Security numbers for your beneficiaries.

- Don’t leave any sections blank; all information is required.

- Don’t alter the form in any way; changes to the beneficiary designation or certification sections will render the form invalid.

- Don’t forget to sign the form in the presence of a notary public.

- Don’t assume that previous beneficiary designations remain valid; all prior designations are revoked upon submission of this form.

- Don’t designate contingent beneficiaries for Group Life Insurance, as this is not allowed.

By following these guidelines, you can help ensure that your beneficiary designations are processed correctly and efficiently. If you have any questions, don’t hesitate to reach out to the South Carolina Retirement Systems for assistance.

Guidelines on Utilizing South Carolina 1102

Completing the South Carolina 1102 form is an important step in designating beneficiaries for your retirement contributions and group life insurance. Once you fill out the form, you will submit it to the South Carolina Retirement Systems. They will process your designations and send you an acknowledgment letter.

- Check the appropriate box in the upper right corner to indicate if you are a new enrollee or changing your beneficiary.

- Select your retirement system by checking one of the following: SCRS, PORS, GARS, or JSRS.

- Complete Section I by providing your personal information, including your last name, first name, social security number, date of birth, address, city, state, and ZIP+4.

- In Section II-A, designate your primary beneficiaries for the refund of contributions or survivor benefits. Provide the name, social security number, sex, date of birth, and relationship for each beneficiary. You can list up to three primary beneficiaries.

- For contingent beneficiaries in Section II-B, provide the same information for up to three contingent beneficiaries. If you do not wish to name any, write "NONE." Remember, contingent beneficiaries only receive benefits if all primary beneficiaries have passed away.

- In Section III, designate beneficiaries for group life insurance. Again, provide the necessary details for each beneficiary. Note that you cannot designate contingent beneficiaries for this section.

- In Section IV, read the certification and conditions carefully. Sign the form in the presence of a notary public. Ensure the notary signs and dates the form as well.

- If needed, attach additional pages if you have more than three beneficiaries. Indicate the total number of pages submitted.

- Submit the completed form to the South Carolina Retirement Systems at the address provided on the form.

Other PDF Forms

South Carolina Department of Natural Resources - The license is an important resource for enjoying South Carolina's natural hunting and fishing environments.

A Missouri Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without guaranteeing that the title is clear. This form is often utilized in situations where the parties know each other, such as family transfers or divorces. For those looking to access necessary documentation, you can find it through Missouri PDF Forms to help complete the process.

Nc Vaccine Registry - Checking the appropriate box indicates if the child meets daycare requirements or requirements for specific school grades.

Sr22 Insurance Sc - Electronic submissions are preferred for efficiency and speed.