South Carolina 1104 Template

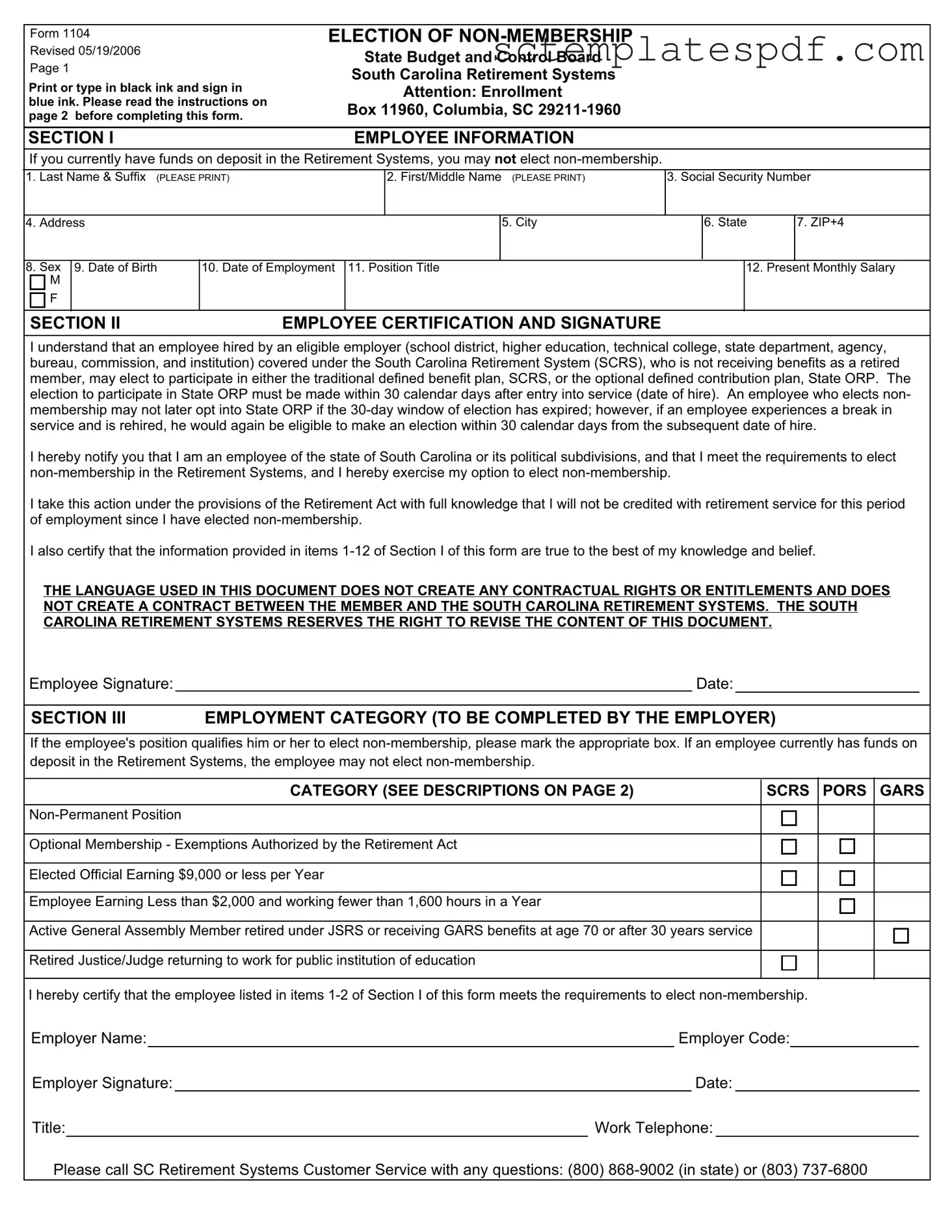

The South Carolina 1104 form plays a crucial role for employees considering their retirement options within the state. This form allows eligible employees to elect non-membership in the South Carolina Retirement Systems, which can have significant implications for their future retirement benefits. It is essential for individuals to understand the conditions under which they can make this election. Employees must complete the form within 30 days of their hire date if they wish to opt for the non-membership status. The form requires basic personal information, such as name, social security number, and employment details, ensuring that the process is straightforward. Additionally, it includes a certification section where employees acknowledge that opting for non-membership means they will not accrue retirement service credit during their employment. Employers also play a role in this process by verifying the eligibility of the employee's position. Understanding the implications of this choice is vital, as it affects future retirement planning and benefits. By carefully reviewing the form and its instructions, employees can make informed decisions about their retirement journey.

Key takeaways

Filling out the South Carolina 1104 form requires careful attention to detail. Here are key takeaways to consider:

- Eligibility Criteria: Only employees who do not have funds on deposit in the Retirement Systems can elect non-membership. Ensure you meet this requirement before proceeding.

- 30-Day Election Window: Employees must make their election to participate in the State ORP within 30 calendar days from their date of hire. Missing this window means you cannot opt into the State ORP later.

- Certification Requirement: Employees must certify their information in Section I is accurate. This includes personal details such as name, Social Security number, and employment information.

- Employer's Role: Section III must be completed by the employer. They must verify that the employee qualifies for non-membership by checking the appropriate category.

- Understanding Non-Membership: By electing non-membership, employees acknowledge that they will not receive retirement service credit for the period of their employment.

- Form Submission: Once completed, the form should be submitted to the South Carolina Retirement Systems. Incomplete forms will be returned, so double-check all sections.

- Customer Service Availability: For any questions or clarifications, employees can contact the SC Retirement Systems Customer Service at (800) 868-9002 or (803) 737-6800.

Dos and Don'ts

When filling out the South Carolina 1104 form, there are important guidelines to follow. Here’s a list of things to do and things to avoid:

- Do print or type your information in black ink. Use blue ink only for your signature.

- Do read the instructions carefully before completing the form. Understanding each section is crucial.

- Do ensure that you do not have funds on deposit in the Retirement Systems if you wish to elect non-membership.

- Do provide accurate information in all required fields to avoid delays or rejections.

- Don't leave any required fields blank. Incomplete forms will be returned.

- Don't sign the form without reviewing all statements in Section II first.

- Don't attempt to elect non-membership if you have already missed the 30-day election window after your hire date.

- Don't forget to have the employer complete Section III if applicable. Their signature is necessary for validation.

Guidelines on Utilizing South Carolina 1104

Filling out the South Carolina 1104 form is a straightforward process. Once completed, the form will need to be submitted to the appropriate employer representative for approval. Ensure that all information is accurate and complete to avoid delays in processing.

- Obtain the Form: Download or request a copy of the South Carolina 1104 form.

- Section I - Employee Information: Fill out your personal details. Provide your last name, first name, social security number, address, city, state, ZIP+4, sex, date of birth, date of employment, position title, and present monthly salary.

- Section II - Employee Certification and Signature: Read the statements carefully. By signing, you confirm your understanding of the non-membership election. Sign and date the form in the designated spaces.

- Section III - Employer Information: This section must be completed by your employer. Ensure they mark the appropriate box to indicate your eligibility for non-membership. The employer must also provide their name, code, signature, title, work telephone number, and the date the form was completed.

- Review: Double-check all entries for accuracy. Ensure that all required sections are filled out completely.

- Submit the Form: Turn in the completed form to your employer for processing.

Other PDF Forms

Nc Vaccine Registry - Each immunization must be listed with its respective date for proper record-keeping.

When engaging in a motorcycle transaction, it's vital to use a proper legal document. The North Carolina Motorcycle Bill of Sale form, an essential aspect of this process, serves as a formal receipt between the seller and buyer. For a thorough understanding, explore our informative guide on the Motorcycle Bill of Sale requirements for a hassle-free transfer of ownership Motorcycle Bill of Sale.

Peba Retirement Login - You can submit a second form if you have more than three beneficiaries to declare.