South Carolina Abl Template

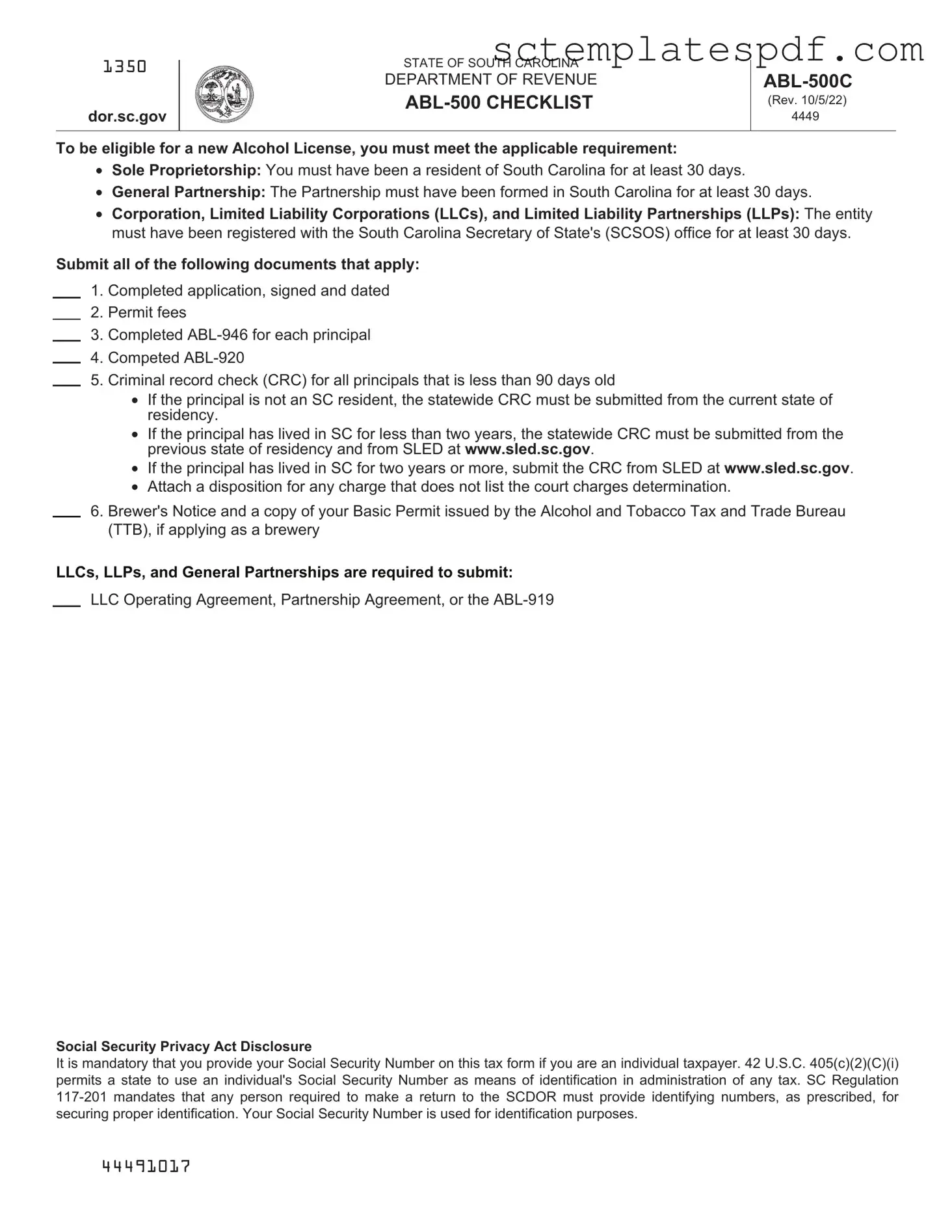

The South Carolina ABL form is an essential document for businesses looking to engage in the production, importation, or distribution of alcoholic beverages within the state. This application process is designed to ensure that all entities comply with state regulations before obtaining the necessary permits. To apply, businesses must first be registered with the South Carolina Secretary of State for at least 30 days, or if a sole proprietor, must be a resident for the same duration. The application requires several key documents, including a completed application form, payment of permit fees, and criminal record checks for all principals involved. Depending on the type of business, additional paperwork may be necessary, such as an LLC Operating Agreement or a Brewer's Notice for breweries. It is also important to note that the application process can take between six to eight weeks, and any delays in approval can impact business operations. Understanding the requirements and ensuring all documentation is accurate and complete is crucial for a smooth application process.

Key takeaways

Filling out and using the South Carolina ABL form requires careful attention to detail. Here are some key takeaways to keep in mind:

- Eligibility Requirements: Ensure your business entity is registered with the South Carolina Secretary of State for at least 30 days before applying. Sole proprietors must be South Carolina residents for the same duration.

- Required Documents: Gather all necessary documents, including a completed application, permit fees, and criminal record checks for all principals. Missing documents can delay your application.

- Criminal Record Checks: If a principal has lived in South Carolina for two years or more, obtain the criminal record check from SLED. For those who have lived in the state for less than two years, checks from both the previous state and SLED are required.

- Social Security Number: Individuals must provide their Social Security Number on the application. This is crucial for identification and tax purposes.

- Designated Agent: Appoint a designated agent to receive all notices related to your license or permit. Keep the SCDOR updated on any changes to this information.

- Processing Time: Be aware that applications typically take six to eight weeks to process. Delays can occur if the application is denied or if additional information is needed.

By following these guidelines, you can navigate the application process more smoothly and increase your chances of a successful outcome.

Dos and Don'ts

Do's:

- Ensure your entity is registered with the South Carolina Secretary of State for at least 30 days before applying.

- Submit all required documents, including the completed application and permit fees.

- Provide a criminal record check that is less than 90 days old for all principals.

- Designate a person to receive notices from the South Carolina Department of Revenue (SCDOR).

- Read and understand the legal requirements for the license or permit you are applying for.

Don'ts:

- Do not submit a PO Box as your business location; provide a physical address instead.

- Avoid leaving any sections of the application incomplete or unsigned.

- Do not ignore the requirement to provide your Social Security Number if you are an individual taxpayer.

- Do not apply if you owe delinquent taxes, penalties, or interest.

- Do not forget to attach any necessary explanations for past license revocations or criminal convictions.

Guidelines on Utilizing South Carolina Abl

Filling out the South Carolina ABL form is a crucial step for entities looking to apply for a beer or wine producer or importer license. The process requires careful attention to detail and the collection of several supporting documents. Following the steps outlined below will help ensure that your application is complete and submitted correctly.

- Gather necessary documents, including:

- Completed application form, signed and dated.

- Permit fees of $400.

- Completed ABL-946 for each principal.

- Completed ABL-920 if applying as a sole proprietor.

- Criminal record check (CRC) for all principals, less than 90 days old.

- LLC Operating Agreement, Partnership Agreement, or ABL-919.

- Brewer's Notice if applying as a brewery.

- Copy of Basic Permit issued by the Alcohol and Tobacco Tax and Trade Bureau (TTB).

- Ensure that your entity is registered with the South Carolina Secretary of State for at least 30 days prior to applying, if applicable.

- Complete the application form, making sure to fill in all required fields accurately.

- Include your Social Security Number as required for identification purposes.

- Designate an agent for compliance who will receive all notices regarding your application.

- Submit the completed application and supporting documents by mail to: SCDOR, ABL Section, PO Box 125, Columbia, SC 29214-0907 or via email at ABL@dor.sc.gov.

- Be prepared for a processing time of at least six to eight weeks.

Other PDF Forms

Nc Vaccine Registry - The signed certificate shows that a qualified professional has confirmed the child's vaccination status.

A Missouri Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without guaranteeing that the title is clear. This form is often utilized in situations where the parties know each other, such as family transfers or divorces. For those looking to access one of these forms conveniently, you can find the necessary paperwork at Missouri PDF Forms.

Sc 1040 Form 2023 Pdf - Amend your declaration if your income, exemptions, or withholding changes substantially.