South Carolina Pt 401 Template

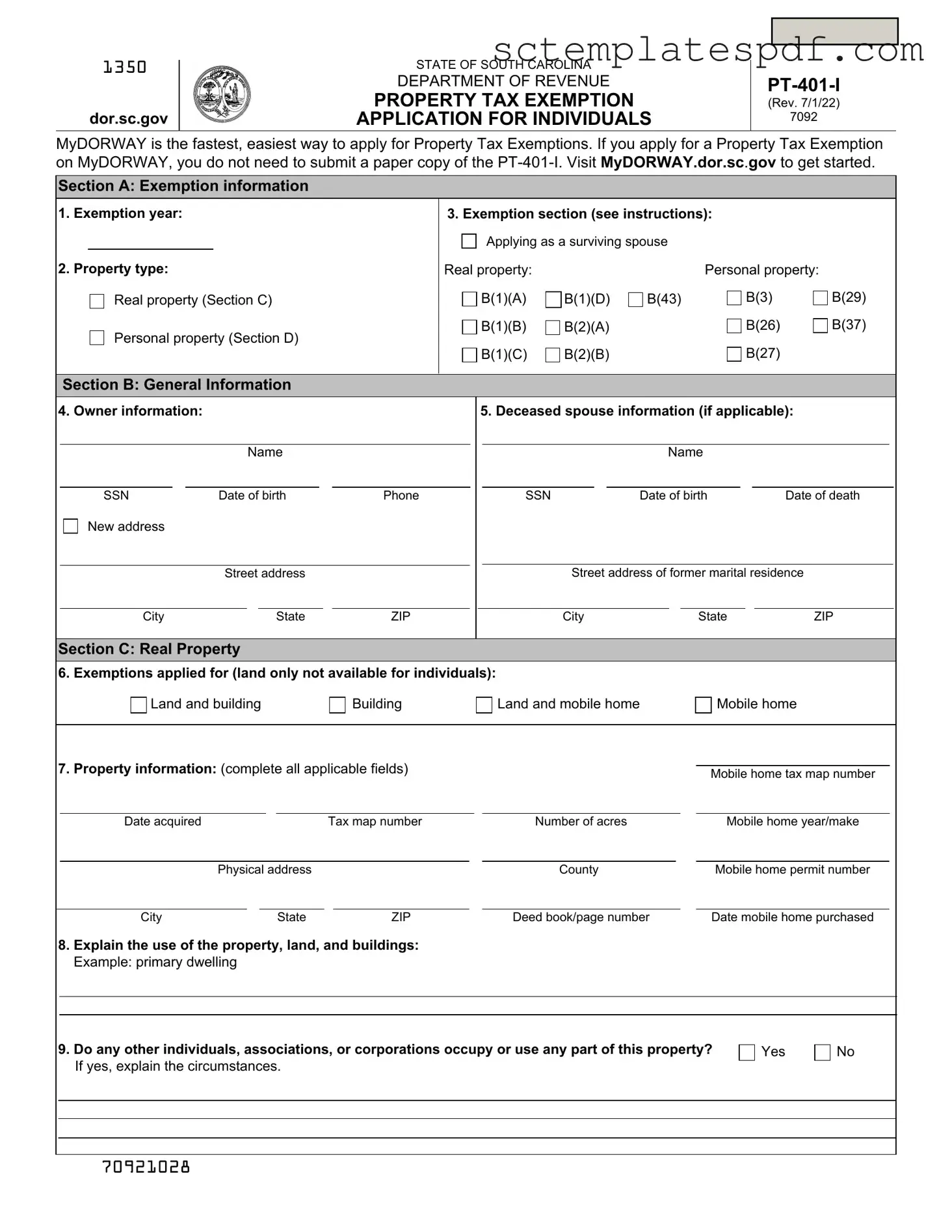

The South Carolina PT 401 form serves as a crucial tool for individuals and organizations seeking tax exemptions on various types of property. This form, officially titled the "Tax Exemption Application," must be filled out with precision by the property owner or an authorized agent. It requires comprehensive information, including the legal owner's details, the property's location, and specific identification numbers. The application process emphasizes the importance of completeness; any omissions can lead to delays in processing. Applicants must specify the years for which they are applying and provide documentation supporting their claims for exemption, whether for real estate, vehicles, or organizational assets. The form outlines various classifications of exempt property under South Carolina law, detailing the types of entities eligible for exemptions, such as schools, charities, and certain veterans' organizations. Furthermore, it highlights the necessary supporting documents that must accompany the application, ensuring that applicants understand the requirements for a successful submission. By navigating the intricacies of the PT 401 form, applicants can better position themselves to benefit from potential tax relief, making it an essential aspect of property management and financial planning in South Carolina.

Key takeaways

The PT-401 form must be filled out completely by the owner or an authorized agent. Incomplete applications will be returned, which can delay processing.

Ensure to provide all required information, including the owner's legal name, address, and identification numbers. This includes Social Security or Federal Identification Numbers.

When applying for real property exemptions, it is essential to indicate the date of acquisition and the county where the property is located.

For vehicle exemptions, you must list the Vehicle Identification Number (VIN), not the license tag number, along with the make and year of the vehicle.

Supporting documents are necessary for various exemptions, such as deeds, IRS determination letters, and financial statements. Be prepared to provide these as attachments to your application.

Dos and Don'ts

- Do: Complete all sections of the PT-401 form accurately.

- Do: Print all requested information clearly to avoid confusion.

- Do: Include all required documentation with your application.

- Do: Mail the completed application to the correct address provided by the South Carolina Department of Revenue.

- Do: Double-check that your application is signed before submission.

- Don't: Leave any sections of the form blank; incomplete applications will be returned.

- Don't: Use abbreviations or unclear language when filling out the form.

- Don't: Submit the application without the necessary supporting documents.

- Don't: Forget to indicate the year(s) for which you are applying for exemption.

- Don't: Wait until the last minute to submit your application, as processing may take time.

Guidelines on Utilizing South Carolina Pt 401

Completing the South Carolina PT-401 form is an essential step for property owners seeking tax exemptions. This process requires careful attention to detail, as incomplete applications may lead to delays. Once the form is filled out correctly, it should be mailed to the South Carolina Department of Revenue for processing.

- Provide Legal Owner Information: Fill in the name, address, and either the Social Security Number or Federal Identification Number of the legal owner.

- Indicate the Year(s) Applying For: Specify the year or years for which you are seeking the exemption.

- Acquisition Date: If applying for real property, indicate the date the property was acquired.

- County Information: List the county where the property is located or registered.

- Property Location: Provide the location of the property if it differs from the mailing address.

- Tax Map Number: Enter the tax map number, which can be obtained from your county assessor.

- Exemption Checkboxes: If applying for real estate exemption, check the applicable boxes on the form.

- Deed Book and Page Number: List the deed book and page number, also available from your county assessor.

- Vehicle Information: If applicable, provide all requested information for vehicles, including the Vehicle Identification Number (VIN), make, and year.

- Attach Additional Information: For organizations applying for furniture and fixtures, include a separate sheet detailing the items, acquisition date, cost, accumulated depreciation, and net value.

Once all sections of the form are completed, ensure that all required documentation is attached before mailing it to the appropriate department. This careful preparation will help facilitate a smoother review process for your application.

Other PDF Forms

Credentia Nurse Aide Registry - The application may also request additional documentation if necessary.

A Missouri Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without guaranteeing that the title is clear. This form is often utilized in situations where the parties know each other, such as family transfers or divorces. For those looking to complete a Quitclaim Deed, resources such as Missouri PDF Forms are available to assist you in the process.

Nc Vaccine Registry - Medical exemptions can be documented, provided they have been authorized by a licensed physician or their representative.