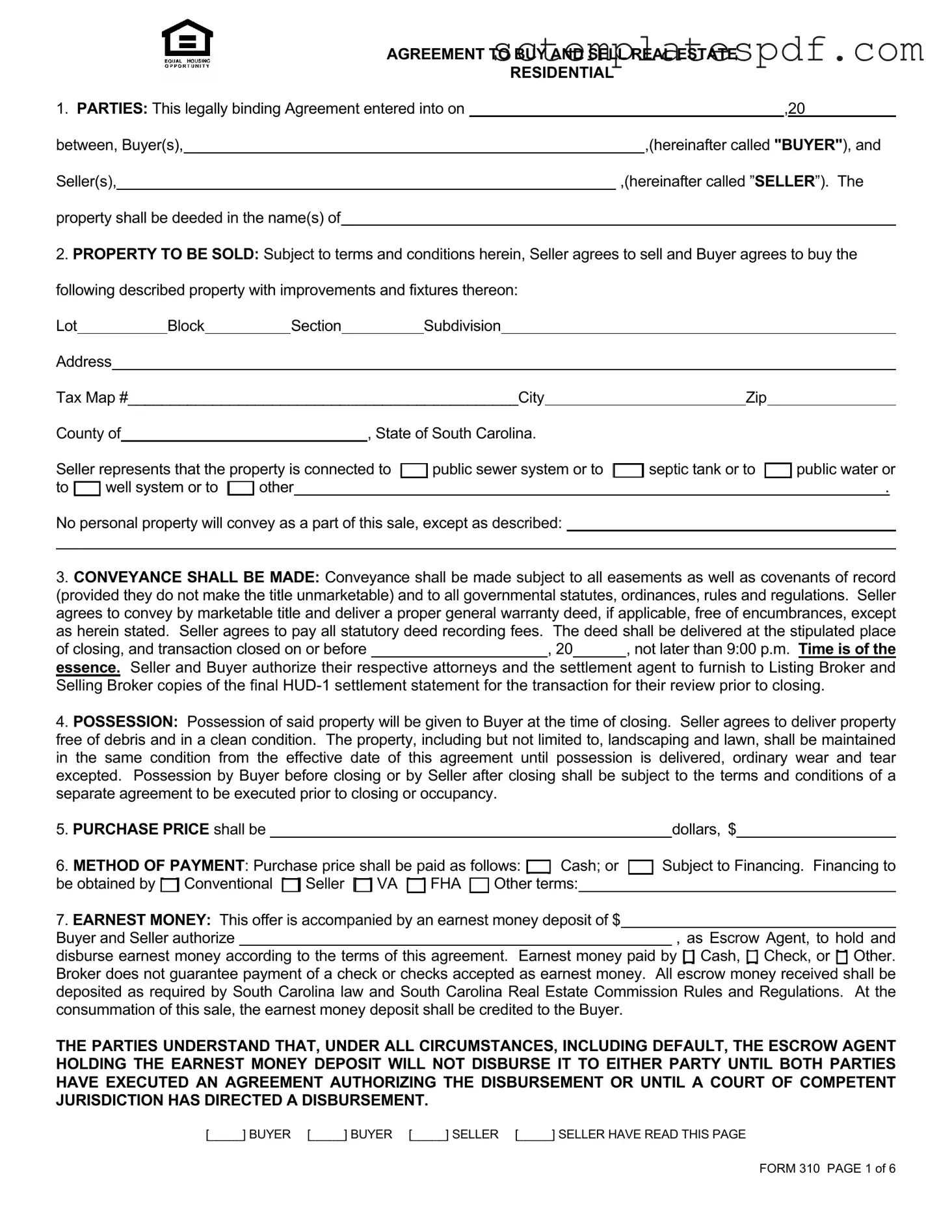

South Carolina Real Estate Contract 310 Template

The South Carolina Real Estate Contract 310 form serves as a crucial document in residential real estate transactions, outlining the terms and conditions under which a property is bought and sold. This legally binding agreement identifies the parties involved, namely the Buyer and Seller, and specifies the property being sold, including its location and any improvements. Essential elements of the contract include the purchase price, method of payment, and the earnest money deposit, which demonstrates the Buyer’s commitment to the transaction. Furthermore, the form addresses the conveyance of the property, stipulating that the Seller must provide a marketable title and deliver the property in a clean condition at closing. The contract also outlines the responsibilities regarding closing costs, inspections, and the condition of the property, ensuring that both parties understand their obligations. Additional provisions cover contingencies, such as financing and inspections, which protect the interests of both the Buyer and Seller. By detailing these aspects, the South Carolina Real Estate Contract 310 form facilitates a smoother transaction process, providing clarity and legal protection for all parties involved.

Key takeaways

Ensure that all parties involved, including buyers and sellers, are clearly identified at the beginning of the contract. This establishes who is responsible for fulfilling the terms of the agreement.

The property details must be accurately described, including the address and any relevant tax information. This clarity helps avoid disputes later on.

Understand the importance of earnest money. This deposit shows the buyer's commitment and is typically credited toward the purchase price at closing.

Be aware of the contingencies related to financing. Buyers must apply for their loan within a specified timeframe, and the seller has the right to terminate the agreement if the buyer fails to secure financing.

Review the closing costs carefully. Both parties should know their financial responsibilities, including who pays for the deed preparation and title insurance.

Dos and Don'ts

When filling out the South Carolina Real Estate Contract 310 form, there are several important dos and don'ts to keep in mind. Following these guidelines can help ensure that the process goes smoothly and that both parties are protected.

- Do read the entire contract carefully before signing. Understanding all terms and conditions is crucial.

- Do fill in all required fields accurately. Incomplete information can delay the process.

- Do consult with a real estate attorney if you have any questions. Legal advice can clarify complex issues.

- Do ensure that all parties involved sign the contract. Missing signatures can render the agreement invalid.

- Don't rush through the process. Take your time to review everything thoroughly.

- Don't make assumptions about verbal agreements. Everything should be documented in writing.

- Don't ignore deadlines. Timely actions are essential to keep the transaction on track.

Guidelines on Utilizing South Carolina Real Estate Contract 310

Filling out the South Carolina Real Estate Contract 310 form is a crucial step in the real estate transaction process. This form serves as a binding agreement between the buyer and seller, outlining the terms of the sale. Below are the steps to properly complete this form, ensuring all necessary information is accurately provided.

- Enter the Date: Fill in the date when the agreement is being signed at the top of the form.

- Identify the Parties: Clearly write the names of the Buyer(s) and Seller(s) in the designated spaces. Specify the full names of all parties involved.

- Describe the Property: Provide a detailed description of the property being sold, including the lot, block, section, subdivision, address, tax map number, city, zip code, and county.

- Specify Utilities: Indicate the type of water and sewer systems connected to the property by checking the appropriate boxes.

- Conveyance Details: State that the seller agrees to convey a marketable title and provide a general warranty deed if applicable. Include the closing date and time.

- Possession Terms: Note when the buyer will take possession of the property and any conditions regarding its condition at that time.

- Purchase Price: Clearly write the total purchase price of the property in both words and numbers.

- Payment Method: Indicate how the purchase price will be paid, selecting either cash or financing options, and specify the type of financing if applicable.

- Earnest Money: Specify the amount of earnest money being deposited and the method of payment (cash, check, etc.).

- Loan Application: State the percentage of the loan and the timeline for applying for financing. Include any relevant loan conditions.

- Closing Costs: Outline who will be responsible for various closing costs, detailing the seller's and buyer's obligations.

- Home Protection Plan: Indicate whether a home warranty will be issued and specify who will pay for it.

- Expiration of Offer: Write the time by which the seller must accept or counter the offer.

- Adjustments: Describe how taxes and other assessments will be adjusted at closing.

- Risk of Loss: State the terms regarding what happens if the property is damaged before closing.

- Default Terms: Specify what happens if either party fails to perform their obligations under the agreement.

- Inspection Terms: Detail the buyer’s right to inspect the property and any responsibilities regarding repairs.

- Appraised Value: Indicate whether the sale is contingent on the property appraising for the selling price.

- Signatures: Ensure all parties sign and date the agreement where indicated, confirming their acceptance of the terms.

After completing the form, it's important to review all entries for accuracy. Once both parties have signed, the agreement becomes a legally binding contract. Keep a copy for your records and ensure that all necessary actions, such as earnest money deposits and loan applications, are initiated promptly.

Other PDF Forms

Nc Vaccine Registry - The form is designed to be straightforward, making it easy for parents to complete.

A Missouri Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without guaranteeing that the title is clear. This form is often utilized in situations where the parties know each other, such as family transfers or divorces. If you need to complete a Quitclaim Deed, you can find helpful resources including Missouri PDF Forms to get started.

Sr22 Insurance Sc - Physicians must certify the illness in the designated section of the form.