State Of South Carolina St455 Template

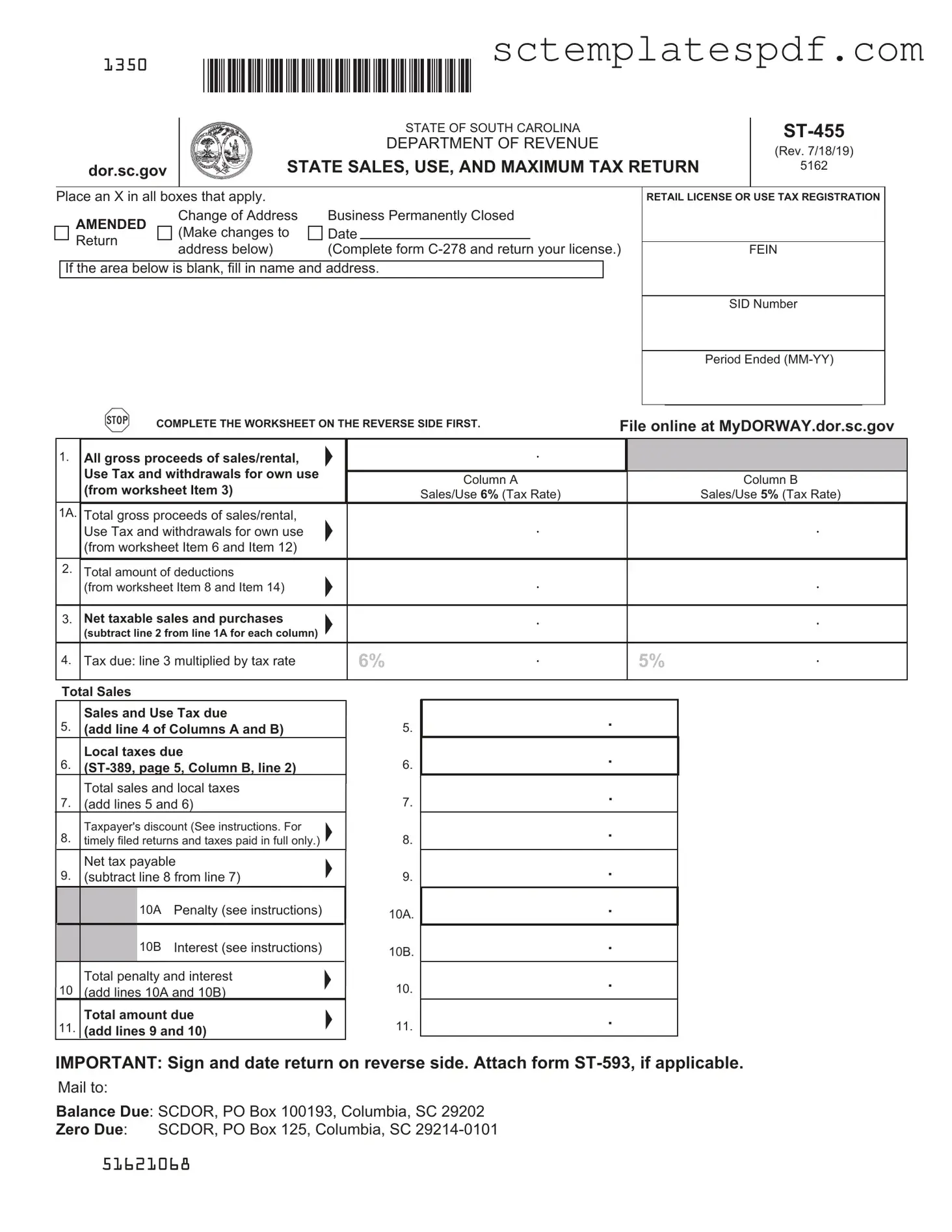

The State of South Carolina's ST-455 form serves as a crucial tool for businesses to report their sales and use tax obligations. This form is designed for retailers and those registered for use tax, providing a structured method to calculate and remit taxes owed to the state. Key elements of the ST-455 include sections for reporting gross proceeds from sales and rentals, deductions, and net taxable sales. Taxpayers must fill out worksheets that guide them through determining their taxable amounts and applicable tax rates, which can vary between 6% and 5%. Additionally, the form requires taxpayers to account for local taxes, if applicable, and includes provisions for penalties and interest on late payments. It is essential for businesses to complete the form accurately, as failure to do so can result in significant financial consequences. By adhering to the instructions and submitting the ST-455 on time, businesses can ensure compliance with state tax regulations while avoiding unnecessary penalties.

Key takeaways

When dealing with the State of South Carolina ST-455 form, understanding the key aspects can make the process smoother. Here are some important takeaways to consider:

- Complete the Worksheet First: Before filling out the ST-455, make sure to complete the worksheet on the reverse side. This will help you gather all necessary figures for your sales and use tax calculations.

- Know Your Tax Rates: The form includes two tax rates: 6% and 5%. Be aware of which rate applies to your sales, as this will affect the total tax due.

- Timely Filing is Crucial: Your return is considered delinquent if it is postmarked after the 20th day of the month following the end of the reporting period. Avoid penalties by filing on time.

- Local Taxes Matter: If local taxes apply, you will need to complete the ST-389 worksheet and attach it to your ST-455. Make sure to include any local tax amounts in your calculations.

- Signature Required: Don’t forget to sign and date your return. This step is essential for validating your submission and ensuring compliance.

By keeping these points in mind, you can navigate the ST-455 form with greater confidence and accuracy.

Dos and Don'ts

When completing the State of South Carolina ST-455 form, it is crucial to follow specific guidelines to ensure accuracy and compliance. Below is a list of dos and don'ts to consider.

- Do fill in all required fields completely, including your name, address, and FEIN.

- Do calculate your total gross proceeds accurately before entering them on the form.

- Do review the worksheet on the reverse side before completing the main form.

- Do sign and date the return on the reverse side before submission.

- Don't forget to attach form ST-593 if applicable.

- Don't leave any boxes unchecked that apply to your situation; mark them clearly.

- Don't submit the form late; ensure it is postmarked by the 20th day of the month following the close of the period.

- Don't ignore local tax requirements; include them as necessary on the ST-389 worksheet.

Guidelines on Utilizing State Of South Carolina St455

Filling out the State of South Carolina ST-455 form is essential for reporting sales and use tax. To ensure accuracy, follow these steps carefully. Completing the form correctly helps avoid delays and penalties.

- Begin by marking an "X" in all applicable boxes at the top of the form, such as for retail license or use tax registration.

- If your business has changed its address or is permanently closed, make the necessary updates in the designated area.

- Fill in your Federal Employer Identification Number (FEIN) and South Carolina Identification (SID) number, if applicable.

- Enter the period ended date in the format MM-YY.

- Before filling out the main sections, complete the worksheet on the reverse side of the form.

- For Column A, report the total gross proceeds of sales, rentals, and withdrawals for own use as calculated in the worksheet.

- For Column B, repeat the same for the 5% tax rate, ensuring all figures are accurate.

- List any deductions in the appropriate section, referencing the worksheet for totals.

- Calculate net taxable sales and purchases by subtracting total deductions from total gross proceeds for both columns.

- Determine the tax due by multiplying the net taxable sales by the respective tax rates for both columns.

- Add the tax amounts from both columns to get the total sales and use tax due.

- If applicable, enter any local taxes due.

- Sum the total sales and local taxes to find the total amount due.

- Apply any taxpayer discounts if eligible, then calculate the net tax payable.

- Include any penalties and interest, if applicable, and sum these amounts to find the final total amount due.

- Sign and date the return on the reverse side of the form.

- Attach form ST-593 if required.

- Mail the completed form to the appropriate address based on whether you owe a balance or have a zero due.

Other PDF Forms

South Carolina Real Estate Law - The terms regarding potential extensions for closing are outlined to accommodate unforeseen delays.

What Is Form 8453 Used for - The decision to elect non-membership affects future retirement planning for employees.

For those navigating the nuances of motorcycle transactions, understanding the functionalities of a reliable Motorcycle Bill of Sale template is vital for ensuring a smooth transfer of ownership. It not only serves as an official receipt but also validates the purchase for both buyers and sellers, enforcing the legality of the exchange. For more insights, refer to this resource: detailed Motorcycle Bill of Sale guidelines.

Sc Alcohol License - Certificates of Label Approval (COLA) must accompany submissions for brand registration.