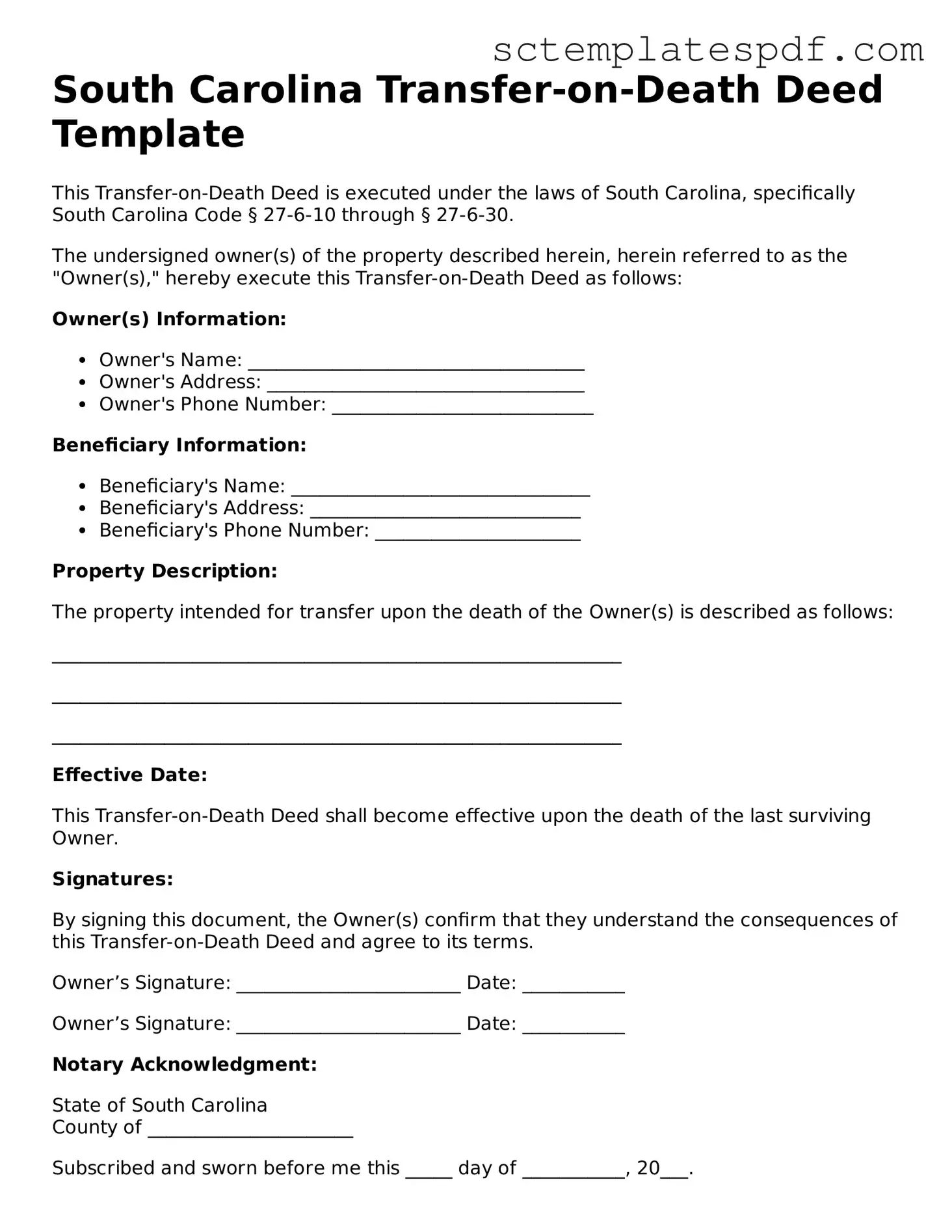

Valid South Carolina Transfer-on-Death Deed Document

The South Carolina Transfer-on-Death Deed form is a powerful tool for property owners looking to streamline the transfer of real estate to their beneficiaries upon death. This form allows individuals to designate one or more beneficiaries who will automatically receive ownership of the property without going through the probate process. By utilizing this deed, property owners can maintain control during their lifetime while ensuring a smooth transition for their loved ones. It's crucial to understand that the deed must be properly executed and recorded to be effective. Additionally, property owners can revoke or change the beneficiaries at any time before their passing, offering flexibility in estate planning. This form is particularly beneficial for those who want to avoid the complexities and potential delays associated with traditional inheritance methods. Knowing how to correctly fill out and file this deed can save families time and money in the long run.

Key takeaways

When considering the South Carolina Transfer-on-Death Deed, there are several important points to keep in mind. This deed allows property owners to designate beneficiaries who will inherit property upon their passing, without the need for probate.

- Eligibility: Only individuals who own real estate in South Carolina can create a Transfer-on-Death Deed.

- Form Requirements: The form must be completed accurately, including the names of the property owner(s) and the designated beneficiary(ies).

- Signature: The deed must be signed by the property owner(s in the presence of a notary public.

- Recording: After signing, the deed must be recorded at the county register of deeds office to be effective.

- Revocation: Property owners can revoke the deed at any time before their death, provided they follow the proper procedure.

- Effectiveness: The deed only takes effect upon the death of the property owner, meaning the owner retains full control during their lifetime.

- Tax Implications: Beneficiaries should be aware of potential tax implications associated with inheriting property.

- Legal Advice: Consulting with a legal professional is advisable to ensure the deed is completed and executed properly.

Dos and Don'ts

When filling out the South Carolina Transfer-on-Death Deed form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here’s a list of dos and don’ts to keep in mind:

- Do ensure that the property description is accurate and complete.

- Do include the full names of all beneficiaries.

- Do sign the deed in front of a notary public.

- Do keep a copy of the completed deed for your records.

- Do file the deed with the county recorder's office where the property is located.

- Don't forget to check for any specific local requirements.

- Don't leave any fields blank; fill out all required information.

- Don't use outdated forms; make sure you have the latest version.

- Don't assume that verbal agreements are sufficient; everything must be in writing.

- Don't neglect to review the deed for any errors before submission.

Guidelines on Utilizing South Carolina Transfer-on-Death Deed

Once you have the South Carolina Transfer-on-Death Deed form ready, it's important to fill it out accurately. This will ensure that your intentions are clearly documented. Follow these steps carefully to complete the form.

- Begin by entering the date at the top of the form.

- Provide your name and address in the designated section. This identifies you as the owner of the property.

- Next, describe the property you wish to transfer. Include the address, parcel number, and any other identifying information.

- In the section for beneficiaries, list the names and addresses of the individuals or entities you want to inherit the property. Ensure that all names are spelled correctly.

- If there are multiple beneficiaries, indicate how the property should be divided among them. Use clear language to avoid confusion.

- Sign the form in the presence of a notary public. This step is crucial for the validity of the deed.

- Have the notary public sign and seal the document. This confirms that you signed the form in their presence.

- Make copies of the completed and notarized form for your records.

- Finally, file the original deed with the county register of deeds office where the property is located. Check for any specific filing requirements or fees.

Other Popular South Carolina Forms

Who Signs Power of Attorney - Unlike a standard Power of Attorney, this version offers long-term security for your affairs.

South Carolina Power of Attorney - {$status} can serve as a critical guide for health care providers during your treatment.

A Missouri Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without guaranteeing that the title is clear. This form is often utilized in situations where the parties know each other, such as family transfers or divorces. If you need to complete a Quitclaim Deed, you can find the necessary documentation at Missouri PDF Forms to get started.

Free Llc in Sc - Incorporators must provide their names and addresses on the form.